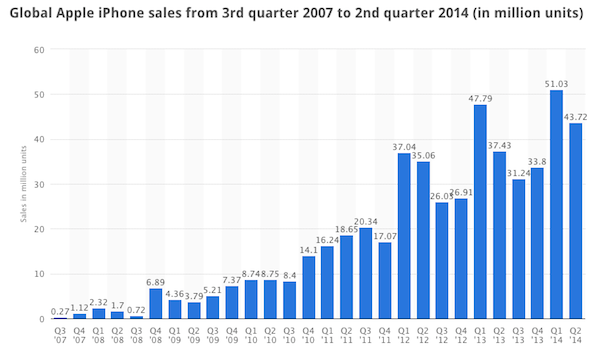

Comparatively, Apple sold 31.2 million iPhones in the year-ago quarter. As reported by AppleInsider, the company has introduced the iPhone on 16 new carriers since April, in addition to launching the smartphone in Brunei, Kosovo, Kazakhstan and Lebanon. Apple now sells the iPhone on 332 carriers worldwide, and the mid-tier iPhone 5c has certainly played a role in boosting sales in emerging countries.

Beyond the iPhone, Um sees Apple having sold 12 million iPads, 3.9 million Macs, and 1.9 million iPods in the quarter. He’s also predicted gross margins of 38.3 percent, higher than Apple’s guidance of 37 to 38 percent, along with earnings per share of $1.27, higher than the Street’s expectation of $1.22.

Despite his expectations of a record quarter, Um is still bearish on Apple’s longer-term prospects than many of his colleagues. The analyst has maintained a “market perform” rating on AAPL stock, with a valuation range of $86 to $96 per share.

Part of his reason for that is a belief that Apple will ultimately have to choose between growth and margins. He said that the remaining opportunity in the smartphone market is smaller in size and better suited to low-end products, a space where Apple does not currently compete.

What do you think ?