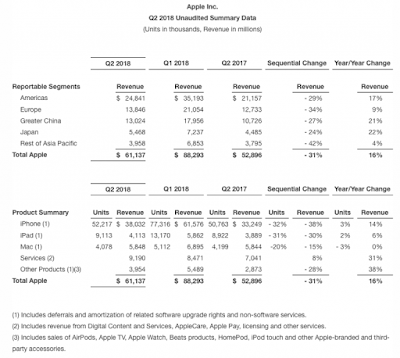

Here are this quarter’s numbers compared to those from Q2 2017:

- Revenue: $61.1 billion versus $52.9 billion, up 16%

- iPhones: 52.2 million versus 50.8 million, up 3%

- iPads: 9.1 million versus 8.9 million, up 2%

- Macs: 4.1 million versus 4.2 million, down 3%

And here are some comments on the numbers from Tim Cook and Apple CFO Luca Maestri:

We’re thrilled to report our best March quarter ever, with strong revenue growth in iPhone, Services and Wearables,†said Tim Cook, Apple’s CEO. “Customers chose iPhone X more than any other iPhone each week in the March quarter, just as they did following its launch in the December quarter. We also grew revenue in all of our geographic segments, with over 20% growth in Greater China and Japan.â€

“Our business performed extremely well during the March quarter, as we grew earnings per share by 30 percent and generated over $15 billion in operating cash flow,†said Luca Maestri, Apple’s CFO. “With the greater flexibility we now have from access to our global cash, we can more efficiently invest in our US operations and work toward a more optimal capital structure. Given our confidence in Apple’s future, we are very happy to announce that our Board has approved a new $100 billion share repurchase authorization and a 16 percent increase in our quarterly dividend.â€

Finally, Apple is providing the following guidance for its fiscal 2018 second quarter:

- Revenue between $51.5 billion and $53.5 billion

- Gross margin between 38 percent and 38.5 percent

- Operating expenses between $7.7 billion and $7.8 billion

- Other income/(expense) of $400 million

- Tax rate of approximately 14.5 percent

[via Apple]